A Data Analytics Approach to Assessing Corporate Financial Health

Goal

Develop a robust data analytics system that accurately evaluates the present financial well-being of a company.

Result

Promising results were achieved in financial diagnosis, with the system having the ability to classify financial context, which is described in financial ratios of different categories. These ratios represent various organizational states, each associated with different issues to be addressed. Additionally, improved competency in managing atypical cases is obtained.

Journal

Iberian Journal of Information Systems and Technologies, November 2021, Pages 153-165

Case

The analysis of business financial health is an important aspect in the organization for its future. It influences decision-making processes such as those related to investments, cash flows, among others. This paper proposes an approach based on autonomous cycles of data analysis tasks for the development of a business financial health analysis system. Said cycle is made up of data analysis tasks based on artificial intelligence techniques that supervise the financial management of the organization, to study its behavior and propose decisions that improve the financial status of the organization.

Which Specific Activities does the System Undertake?

Three types of activities:

The monitoring tasks are responsible for processing the financial information of the organization to define possible organizational states.

The analysis task classifies the organization into one of the possible organizational states based on its financial ratios.

Finally, in the decision-making task, actions are determined to drive sustainable growth according to the identified organizational state.

What Information is Used to Supply the System?

Financial ratios extracted from the financial statements are inputted to the system. All the ratios to be used belong to the categories of liquidity, growth, leverage, solvency, profitability, or efficiency, with the aim of achieving an integral view of the organizational state or financial health.

Which Algorithms Were Applied for the Classification Process?

Three techniques from the field of machine learning were used, specifically in the area of unsupervised learning (clustering), namely Mean Shift, DBSCAN, and Gaussian Mixture. These algorithms are distance-based, density-based, and probability-based, respectively.

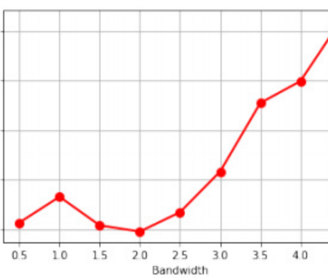

Silhouette Metric - Mean Shift

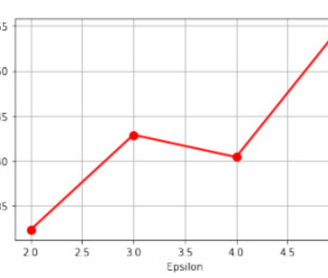

Silhouette Metric - DBSCAN

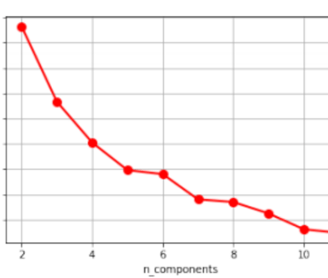

Calinski-Harabasz – Gaussian Mixture

Which Algorithm was Best Suited and Why?

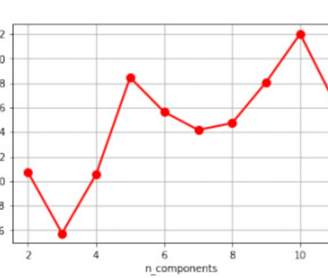

Given that in the case of both Mean Shift and DBSCAN there is a disproportion in the size of the clusters, Gaussian Mixture was chosen as the most robust model once the data had been normalized.

Davies-Bouldin Metric- Gaussian Mixture

What Types of Companies Can Be Evaluated with This Approach?

Publicly listed companies with a minimum of five years' financial data can undergo analysis. The paper includes a practical case study involving Microsoft Corporation to exemplify how the system offers a diagnostic evaluation of the company's financial health. This evaluation can be applied in subsequent periods to assist in monitoring the organization's financial well-being.

What is the Main Contribution of this Project?

Robustness and interpretability. The project's main contribution lies in its innovative use of data analytics and clustering techniques to determine the financial health of organizations. By moving beyond traditional linear discriminants and incorporating interpretability in the output, the project provides a more user-friendly and applicable system for assessing and recommending organizational states.